The Cornerstone Housing® Initiative

The Housing Crisis

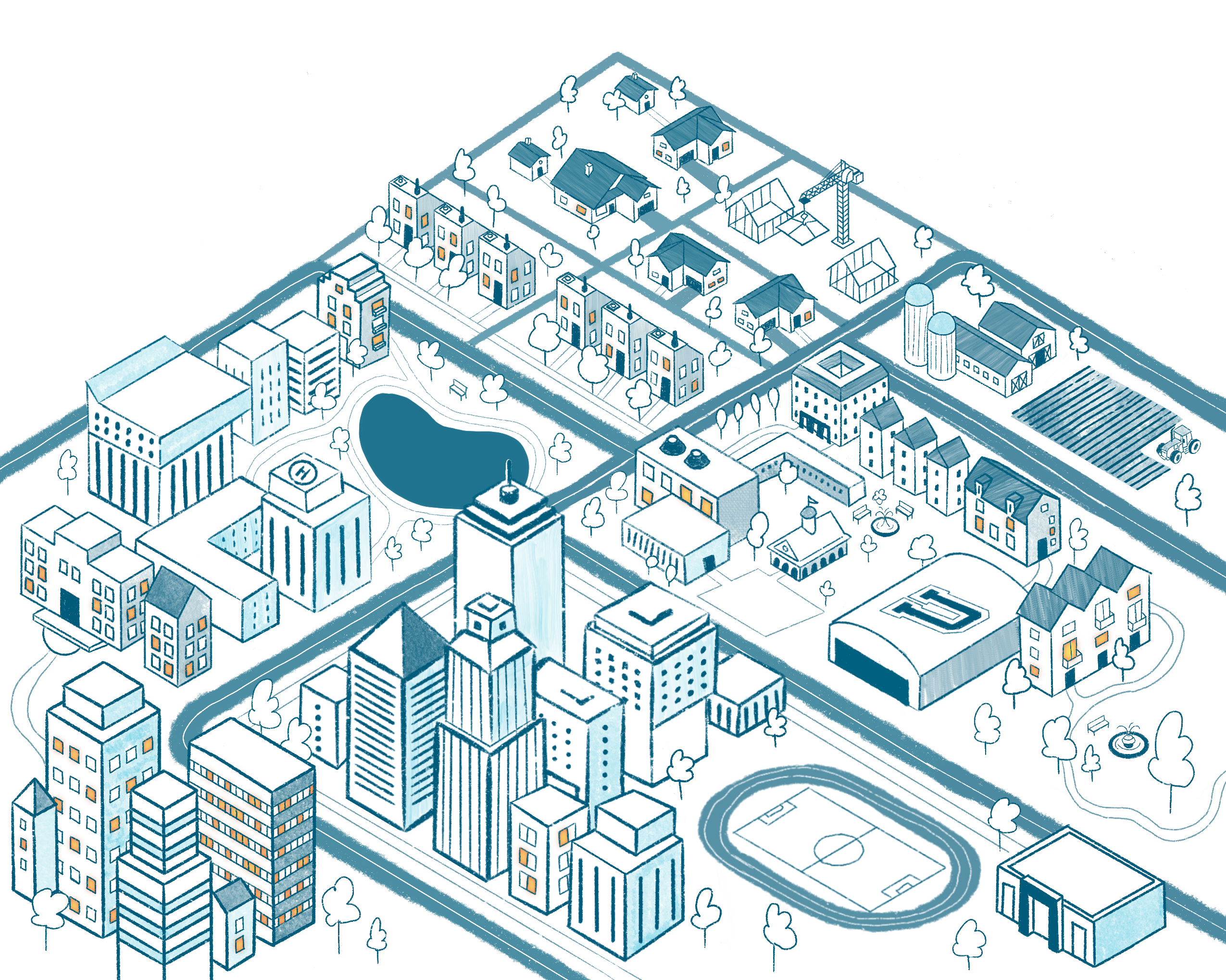

Housing is the cornerstone of community progress, but today the housing system is broken.

Housing is the Cornerstone

Home is where children get ready for school, where seniors age with dignity, and where people rest after a long day of work. The importance of home in our lives and our communities means that affordable and stable housing is not just about shelter—it is the foundation for thriving individuals, families, and communities.

At its best, a housing system makes that foundation strong for everyone. When housing is affordable and accessible, people don’t just stay afloat, they get ahead. Workers can afford to live near their jobs, reducing transportation burdens. Schools benefit from steady student enrollment. Businesses thrive where talent supply is plentiful and their employees and customers can put down roots nearby. Stress levels decrease and community health improves.

Download our Housing+ reports for more information about how housing is the cornerstone of community progress.

A System in Crisis

In a thriving housing system, housing serves as a platform for opportunity—not a barrier to it. But today the housing system is broken and creating barriers to community progress. The growing housing crisis threatens the health of our families, the strength of our economy, and our collective future. Here are three key points to help you understand the scale of the crisis facing Central Florida today.

1. The faces of the housing crisis aren’t who you expect.

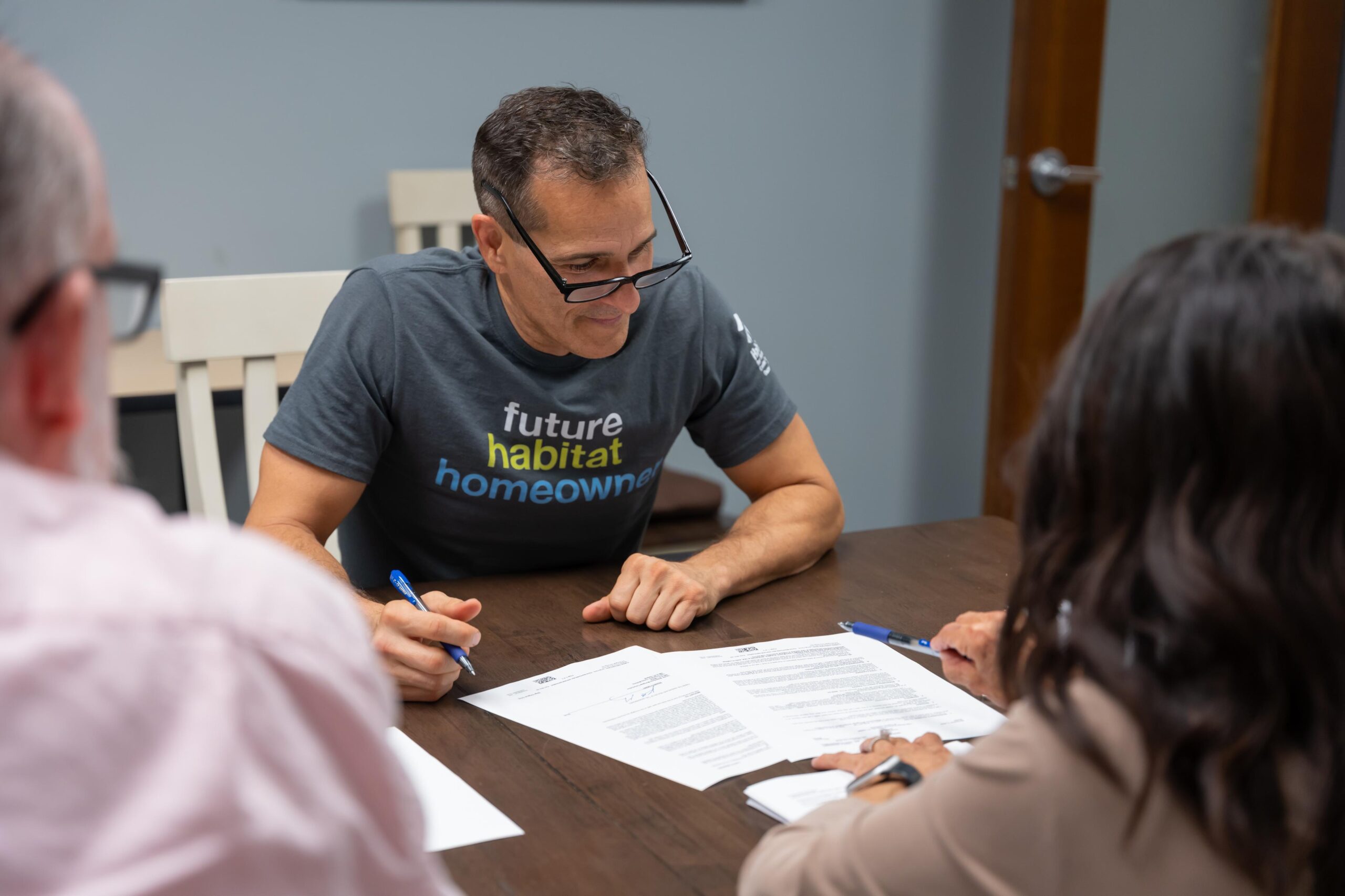

At Habitat for Humanity Greater Orlando and Osceola County, we work with Central Floridians every day who struggle to find affordable housing. Our clients include teachers, safety managers, human resource professionals, nurses, head chefs, equipment technicians, mail carriers, firefighters, truck drivers. When the people who hold our community together can no longer afford to live here, everyone struggles. Our Face the Housing Crisis campaign featured real Habitat homeowners. Listen to their housing stories below.

Rhonza

Kenneth

Donya

Robert

2. Wages have gone up; affordability has not.

In recent years, many essential workers have had their wages go up. But instead of opening more doors, the number of opportunities to find affordable housing, either for purchase or for rent, has shrunk. This eroding affordability is a clear sign that wage growth alone isn’t enough to solve the housing crisis.

The trend is not just a sign of general inflation—it’s a sign that the housing market is out of alignment. If wages go up but we don’t fix the bottlenecks in the housing system, all we do is shift the problem: more people competing for the same limited supply drives prices even higher.

Find more information about eroding housing affordability in our Research Library.

3. The crisis looks different for everyone.

The housing crisis isn’t just about building more homes — it’s about access and long-term stability. The housing system is broken in many ways:

First-time buyers are shut out of the market by high down payments, poor credit access, or lack of financial guidance.

The “missing middle” of housing, like duplexes, townhomes, or small-scale rentals, is often zoned out of existence.

A renting family’s home choices are diminished by application fees, high move-in fees, or monthly income requirements.

Seniors struggle to afford the repairs or insurance needed to stay in the homes they already own.

This is what we mean when we say the housing system is broken.

It is not just one issue calling for one solution; it’s a system of interconnected barriers that require coordinated, long-term action.

Learn More

Explore the various aspects of the Cornerstone Housing® Initiative by choosing from the options below.